Why Stability Matters More Than Ever in Today’s Market

Markets are meant to move — but when they swing with increasing speed and force, even seasoned investors start to question the old playbook.

The Era of Uncertainty

Markets are meant to move — but when they swing with increasing speed and force, even seasoned investors start to question the old playbook.

Over the past five years, global portfolios have faced:

- A global pandemic

- Historic rate hikes

- A tech-driven boom and bust

- Banking sector tremors

- Ongoing geopolitical tension

What’s been missing? Stability. And today, it matters more than ever.

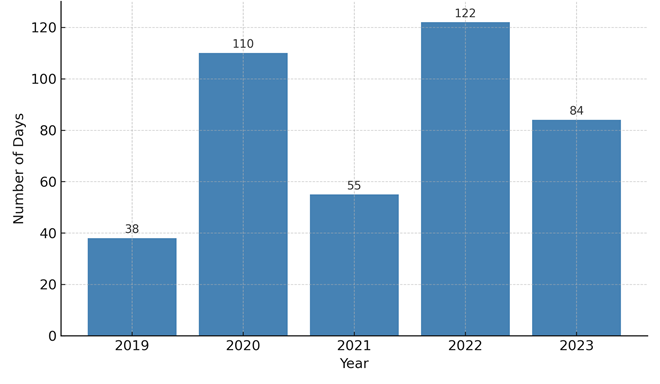

Market Volatility by the Numbers

Let’s take a closer look at the S&P 500, which is often used as a proxy for investor sentiment and market confidence.

One key measure of volatility is the number of trading days where the index moves more than 1% in either direction — up or down — from the previous day’s close. These swings reflect uncertainty, often triggered by macroeconomic news, earnings surprises, or rate expectations.

Number of 1%+ Volatility Days (up or down) in the S&P 500 (2019-2023)

Source: MarketWatch, 2022 S&P 500 Volatility

In 2019, the S&P 500 saw just 38 days of such high volatility. By 2022, that number had surged to 122 days — the highest since the global financial crisis. Even in 2023, with rate hikes slowing, markets recorded 84 days with 1%+ moves.

For investors seeking stability, particularly those relying on consistent income, this kind of turbulence can make traditional portfolios feel like a moving target.

The Case for Stability

As Ray Dalio once said:

“He who lives by the crystal ball will eat shattered glass.”

Trying to time markets, predict the next rate cut, or rotate portfolios too often invites fragility. Instead, investors are seeking consistency over excitement, especially when it comes to income-generating assets.

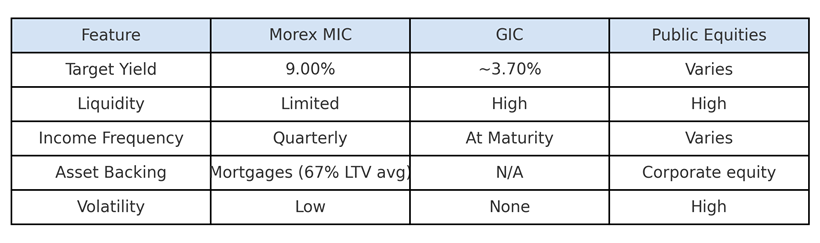

Where Does Morex MIC Fund Fit In?

A Mortgage Investment Corporation (MIC) like Morex Capital offers exposure to an entirely different engine: short-term, real estate-backed lending.

Why it matters:

Morex MIC Fund is designed to deliver steady income with limited price volatility, regardless of daily headlines.

The Psychology of Calm Investing

In turbulent markets, psychological resilience is just as important as financial performance.

Investing in vehicles that produce predictable outcomes, secure income, and measurable risk allows investors to focus on long-term goals, not short-term stress.

Morex MICs, by their very design, prioritize capital preservation while still delivering attractive returns. That’s not a contradiction. It’s the outcome of a deliberate investment philosophy.

Final Thought

Markets will always fluctuate. But your income stream doesn’t have to.

As investors shift from chasing yield to managing risk, the value of stability — true, enduring stability — becomes clearer. And in that search, Morex stands ready to help you build not just a better portfolio, but a more resilient financial life.

Disclaimer

This article is for informational and educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, including shares of the Morex MIC Fund. Any investment decision should be made only after reviewing the offering memorandum and consulting with a licensed financial advisor. The Morex MIC Fund is available only to eligible or accredited investors under applicable Canadian securities laws.

Mortgage investing involves risks, including the potential loss of capital, limited liquidity, and may not be suitable for all investors. Investments in a MIC are not guaranteed or insured.

For full details, please refer to our Offering Memorandum and consult with your advisor.