Geopolitical Risk & Diversification: Gold and Private Credit in the New Era of Volatility

From the Middle East crisis to the war in Ukraine, and the increasingly fraught relations between the U.S., China, and Russia, investors are facing an era where geopolitics plays a central role in capital markets.

Investing in a Fragmented World

From the Middle East crisis to the war in Ukraine, and the increasingly fraught relations between the U.S., China, and Russia, investors are facing an era where geopolitics plays a central role in capital markets. The days of globally synchronized growth are giving way to a multipolar world—one where supply chains are shifting, tariffs wars are causing chaos, and inflation is less predictable.

In this environment, traditional portfolios may no longer offer sufficient protection. That’s why many institutional and conservative investors are diversifying into gold and private credit—two assets that behave differently from public equities and provide insulation from geopolitical shocks.

Gold: The Classic Hedge Makes a Comeback

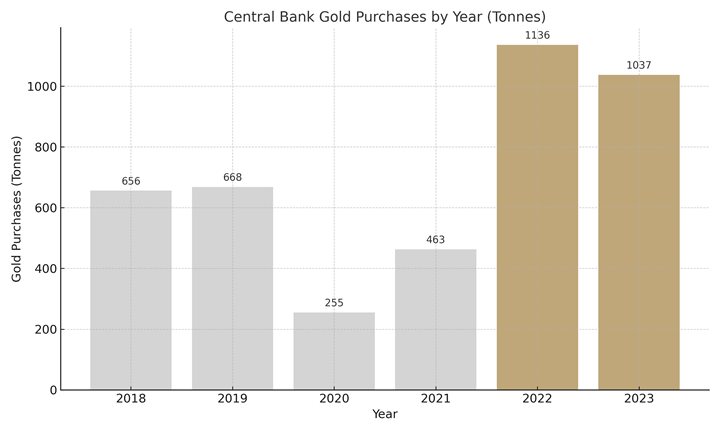

Historically, gold has been a safe haven in times of geopolitical risk. In 2023 alone, central banks purchased over 1,000 tonnes of gold, marking the second-highest annual purchase in history, according to the World Gold Council.*

Recent trends suggest gold’s utility is expanding beyond crisis hedging. As real interest rates flatten and sovereign debt concerns mount, gold is being embraced as a non-yielding asset with strategic long-term value. The yellow metal has held above $2,300/oz in Q2 2025, despite equity market rallies.

Central Bank Gold Purchases

Source: World Gold Council

Private Credit: Quietly Filling the Gap

As banks pull back due to capital constraints and rising default risks, private credit is stepping in. This market now exceeds $1.6 trillion globally. * In Canada, private mortgage lending is growing steadily as borrowers seek alternatives to stricter bank underwriting.

Unlike high-yield bonds, private loans are often secured and negotiated directly, allowing for customized terms, real collateral, and downside protection. Mortgage Investment Corporations (MICs), a subset of private credit, are particularly relevant in Canada. They provide short-term residential lending backed by real estate and structured for income stability.

Diversification in Practice

Diversification isn't just about owning more things—it's about reducing exposure to correlated risks. In 2022, both equities and fixed income fell in tandem, breaking the 60/40 portfolio model many investors relied on. The new frontier of diversification includes:

- Physical assets like gold, real estate

- Private credit with low equity correlation

- Alternatives that hedge inflation and systemic shocks

Together, gold and MICs can provide downside buffers, income generation, and resilience in portfolios impacted by policy surprises or geopolitical stress.

Final Thought: Risk Repriced

The modern investor is navigating a world where inflation is sticky, alliances are fluid, and markets are reactive. Strategic asset allocation in this context requires humility and a toolkit that goes beyond public equities.

Gold and private credit, long considered a niche, are proving their value in this new global order. For risk-aware investors, these aren’t speculative plays—they’re foundational moves toward stability and smart diversification.

Disclaimer

This article is for informational and educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, including shares of the Morex MIC Fund. Any investment decision should be made only after reviewing the offering memorandum and consulting with a licensed financial advisor. The Morex MIC Fund is available only to eligible or accredited investors under applicable Canadian securities laws.

Mortgage investing involves risks, including the potential loss of capital, limited liquidity, and may not be suitable for all investors. Investments in a MIC are not guaranteed or insured.

*Sources: World Gold Council 2023 Annual Review, Preqin Private Credit Q1 2025 Outlook, FSRA Ontario 2024 MIC Trends Report